-

Mortgage Underwriting Services

We offer outsourced mortgage underwriting services to mortgage lenders nationwide. Our contract mortgage underwriting services include Credit, Income, Asset and Collateral Analysis, and also involves Ratio Analysis, Regulatory Compliance, Fraud Detection and finally recommending the Loan Decision. We enhance customer satisfaction by providing fast underwriting turntimes and guideline clarification to retail lending branches which facilitated rapid approval of loan applications.

As an outsourced contract underwriter, our key responsibilities are to evaluate and analyze the Mortgage loan, evaluate applicant credit worthiness, price the loan in accordance to applicant risk class and market rate, generate and clear stips, and render the final decision.

Our underwriters are trained on mortgage procedures and documentation, residential mortgage guidelines, federal regulations, all major LOS, Investor Overlays and product specific updates. The services include:- Running DU / LP (Automated Underwriting System)

- Credit Review

- DO Findings Review

- Income Calculation

- Title Review

- Appraisal Review

- Asset Review

- LQI Checks

- Generating Stips

- Clearing Stips

Origination Mortgage Underwriting Services

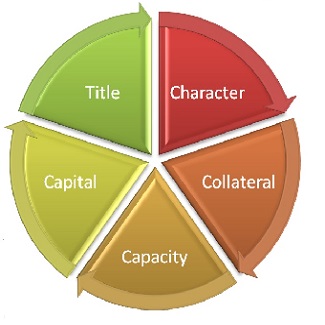

We analyze the mortgage documents in five major underwriting areas (Credit, Appraisal, Income, Fund & Title) and calculate the LTV & DTI (Front-end & Back-end ratios) using the documents submitted by the borrower and providing the detailed analysis report to the US underwriters:

- Service

- Character - Credit Analysis Analyze Character (willingness to repay) and credit worthiness through analysis of Credit Report, Bankruptcy, Judgments, Foreclosure, Divorce Decree, Verification of Rent (VOR), Child support and Alimony paid documents etc.

- Collateral - Property Analysis Analyze the subject property in detail based on Appraisal Reports, Property profiles, HUD-1 Settlement, Rental Agreements & Calculation of Hazard Insurance, Real Estate Taxes and Mortgage Insurance etc

- Capacity - Income Analysis Analyze Capacity to repay through the income documents (Paystubs, Tax Return, W-2's etc.)

- Capital - Fund Analysis Analyze Capital through the Bank/Asset Statements & Verification of Deposits (VOD)

- Legal Ownership - Title Analysis Analyze the Legal Ownership of the property through the Title Reports & Plat Maps

- Verify information listed on the loan application and obtain additional documents required

- Pre-qualify the borrower, based on the FICO & Overall current financial conditions of the borrower

- Evaluate customer profile as per strict compliance standards

- Assess the risk profile of the applicants based on the 4 Cs determining the appropriate risk class

- Evaluate DTI, LTV and various ratios

- Review Automated Underwriting results

- Ensure that the loan meets all the Fannie Mae guidelines and investor overlays

- Review the property appraisal to determine whether the property represents adequate collateral for the loan

- Do Appraisal Logging and FHA Connections for FHA Insured Loans

- Review Mortgage Note, Title and Public records in credit report

- Complete all underwriting worksheet and income calculations

- Determine and document Stips and communicate them

- Verify and approving the stips once they come in from the broker / LO

- Complete the final underwriting check before submission so as to minimize conditions

- Render final loan decision whether it is approved, declined or denied with valid conditions for the same

- Issue Clear-To-Close

Mortgage Modification Underwriting Services (HAMP / Non-HAMP)

Loan modifications typically involve a change in the interest rate, an extension of the term, capitalization or reduction of the principal amount. We :

- Check the credit report of the borrower to ascertain his credit & repayment history

- Review, Derive & Validate the income of the borrower from the income documents.

- Modify a loan for the entire tenure by changing the interest rates & monthly mortgage payments

- Modify Delinquent loans and subsequently reduce the default levels

- Use loan modification tools and underwriting according to servicing guidelines

- Do Approval/Quality Check of Modification Plans prepared by Home retention Consultants

- Meet the Investor, Servicer & Mortgage insurer guidelines with great accuracy and efficiency

- Analyze loan history, asset attributes, and investor guidelines whether the modification is appropriate

- Check whether the homeowner qualifies for the new HAMP modification program

- Perform a thorough review of each account's financial hardship, including detailed pay history review, DTI analysis, foreclosure rules and guidelines

- Determine financial capacity and commitment of each homeowner

- Order interior and exterior inspection on mortgaged property and make sure that is received on time

- Provide customized modification solutions in order to provide the right solution for the homeowner

- Re-underwrite loans based on customer's financial position and repayment capacity

- Partner with the Loss Mitigation / Loan Resolution Specialist when a severity / frequency mitigation deal is the optimal solution

- Calculate the Net Present Value of the property & determining the best possible solution

-

Underwriting Services

- Origination Underwriting

- Modification Underwriting

Loan Types We Underwrite- Conventional & FHA

- Purchase

- Refi, HARP 2.0, DU Refi Plus

We Underwrite To- Fannie Mae Guidelines

- Specific Investor Overlays