Cut Your Mortgage Processing & Underwriting

Costs by upto 50%

- Close Loans Faster

- Improve Customer Service

- 24x5 Contract Loan Processors

- 24x5 Contract Mortgage Underwriters

-

We are an outsourced contract mortgage processing company that works side by side mortgage lenders, banks and credit unions to help them close more mortgage loans and reduce overheads.

We specialize in underwriting Conventional, FHA and VA loans. We offer years of mortgage underwriting outsourcing experience in underwriting purchase and refinance loans. Our mortgage underwriting services come with fast and guaranteed turntimes! -

We provide contract loan processors, mortgage underwriters, title specialists, appraisal reviewers, closers, compliance and audit staff and mortgage outsourcing services to execute all phases of loan processing, title, appraisal, underwriting, closing and audits. We work for:

- Mortgage Banks

- Mortgage Lenders

- Credit Unions

- Upto 25k loans per month

-

Our Mortgage Loan Processing Services help Mortgage Banks & Lenders to:

- Close loans faster

- Concentrate on getting more loans

- Increase closings with faster turnaround

- Eliminate the cost of hiring in-house

underwriters and processors

-

Mortgage Outsourcing Services

Contract Mortgage Processing | Mortgage Underwriting Outsourcing | Title | Appraisal | Loan Processors

About MortgagePro360

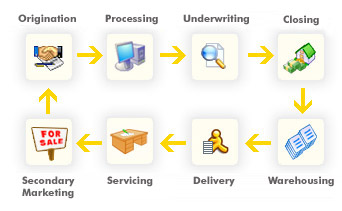

About MortgagePro360We provide experienced contract loan processors, outsourced mortgage underwriters and mortgage back-office outsourcing services to execute any or all phases of mortgage processing, title, appraisal, underwriting, loan closing, loan servicing and post-closing audits.

Our team of mortgage processors and underwriters are recruited and trained extensively to support a variety of origination and loan processing services - from loan setup to underwriting to closing - with a very fast turnaround.

We offer custom mortgage outsourcing services to meet mortgage industry needs. Our mortgage outsourcing services spans across over 60 different processes in mortgage lifecycle. Our Mortgage Loan Processors allow our clients to focus on their core competencies by leveraging our loan processing experience and resources. Our 24x5 loan processing and underwriting services allow lenders and brokers to let us do all the heavy lifting while they can focus on building client relationships.Why Outsource Mortgage Processing Services?Whether you're looking for a quick solution or require a complete outsourced mortgage processing solution, MortgagePro360 is the answer. We provide:

- High level of client service & fast turnaround

- Better cost management

- Flexible costs in changing market conditions

- Better risk management with regulatory compliance

Expand your business - Manage Fluctuating Volume Free your loan officers to focus on sales. We do all the processing while keeping your LO, LOA, AE and Processors informed. On-demand, scalable & reliable infrastructure - Scale your business as needed without heavy investments. Close three to five times more loans with your existing loan processors.

Free your loan officers to focus on sales. We do all the processing while keeping your LO, LOA, AE and Processors informed. On-demand, scalable & reliable infrastructure - Scale your business as needed without heavy investments. Close three to five times more loans with your existing loan processors.

Decrease Your Loan Processing Costs - Lower Cost per Loan Reduce processing costs - Up to 50% lower than industry average processing costs. Recruiting, training and retaining loan processors is expensive and time consuming - and is time you could spend closing more loans! If you are frustrated with re-training loan processors, paying for salaries, benefits, sick time, vacation, and workman's compensation - outsource loan processing to us.

Reduce processing costs - Up to 50% lower than industry average processing costs. Recruiting, training and retaining loan processors is expensive and time consuming - and is time you could spend closing more loans! If you are frustrated with re-training loan processors, paying for salaries, benefits, sick time, vacation, and workman's compensation - outsource loan processing to us.

Offer Faster Turntimes with Better Client Service Loans managed by Industry experts with large multinational company experience. Underwrite loans faster with guaranteed turntimes and 24x5 coverage.

Loans managed by Industry experts with large multinational company experience. Underwrite loans faster with guaranteed turntimes and 24x5 coverage.

Increase Your Closing Ratio Pro-active notifications based on your preferred method of communication. We raise red-flags early so that the loan applications that are processed have higher chance of closing and meeting all lender and compliance requirements.

Pro-active notifications based on your preferred method of communication. We raise red-flags early so that the loan applications that are processed have higher chance of closing and meeting all lender and compliance requirements. -

Our Mortgage Services- Loan Processing

- Title Search / Exam

- Appraisal Review

- Mortgage Underwriting

- Loan Closing

- Post-Closing Audits

- Loan Servicing

- Contract Loan Processor

- Contract Underwriter

- Investor Accounting

Why Choose Us- Conventional, FHA & VA Loans

- 1500 Full-Time Processors

- 100 Full-Time Underwriters

- 30,000 sq.ft. Office

- ISO 27001 Certification

- Soc 2 Type 2 Certification

- US Toll-Free Phone / Fax Lines

- Secure Data Servers in US

- 24 x 7 Operations

- Mortgage Industry Expertise

- No frills, SIMPLE pricing model

Area of Expertise- Loans - Conventional, FHA, VA

- Purpose - Purchase Refinance

Mortgage Software- Encompass360 ®

- PC Lender ®

- Lender's Office ®

- Calyx ® Point / LendingQB ®