-

Mortgage Loan Processing Services

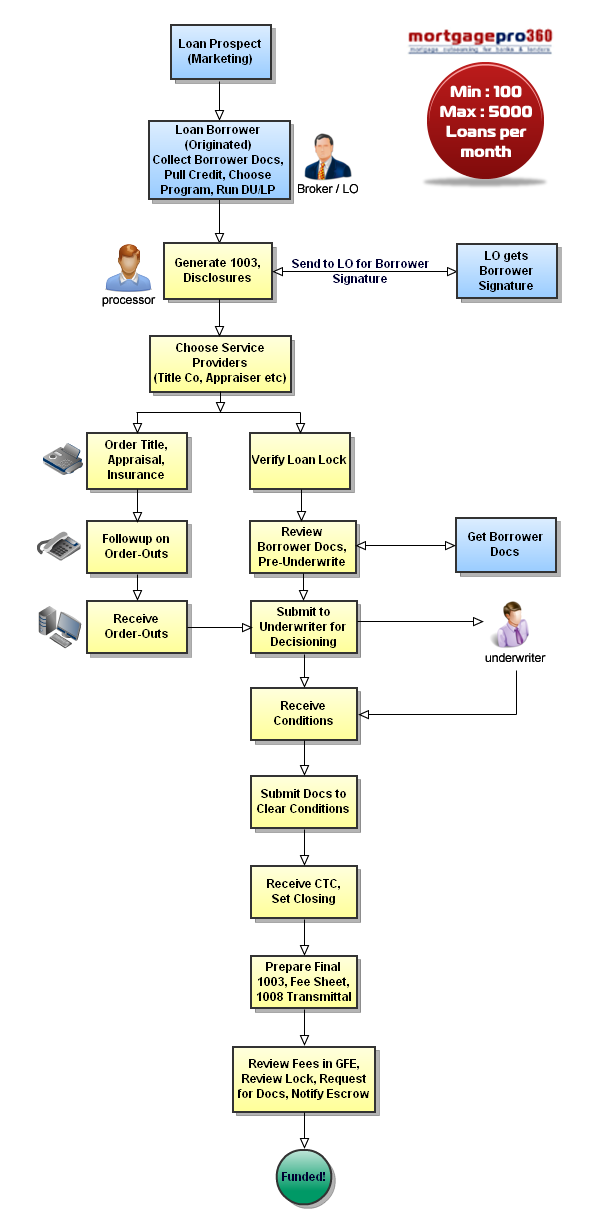

Our Loan Processing Services can assist mortgage brokers and lenders in streamlining their business processes to reduce loan processing time, processing costs and increase their ability to close more loans. We can provide you with a custom-fit business solution to help you originate loans in complete compliance with regulations. We check the entire package and communicate with Mortgage Broker, LO, LOA and Underwriter at every step in the process.

Loan Processing Outsourcing

Our Contract Loan Processors

- Collect & Review Borrower Docs (Paystubs, W2-s, 1040, Bank Statements, Pension Statement, Divorce Decree, Child Support, Mortgage Statements, Escrow Documents etc)

- Pull Credit Report

- Enter Uniform Residential Application (Form 1003) in LOS

- Generate GFE and TIL Disclosures

- Collect Signed Disclosures

- Verify Disclosures are Accurate and Complete

- Order VA and FHA Case Numbers for Government loans

- Order Title and Payoffs

- Order Appraisal, Flood Cert, VOE, VOR, VOD, VOM

- Order Insurance and Survey, if applicable

- Verify Lock

- Submit to Lenders / Underwriters

- Clear Conditions

- Receive CTC and set Closing

- Prepare Closing Docs

How Outsourcing Loan Processing HelpsChallenge: Inconsistent loan volume can make it difficult for lenders of all sizes to maintain consistent profit margins. Furthermore, hiring full-time specialized loan processors for each step in the loan processing cycle can be costly, especially during market downtimes.

Solution: We offer outsourced loan processing services that cover every incremental step of the cycle, from loan application receipt to loan closing to servicing transfer, thereby replacing the need for expensive in-house loan processors. -

Third Party Documents

- Appraisal

- Title

- Insurance

- HOI

- Payoff

- 4506-T

- Other Docs

Verifications- Verification of Employment

- Verification of Income

- Verification of Deposit

- Verification of Insurance

- Verification of Rent

- Verification of Mortgage

Processing Details- Conventional, FHA, VA, Harp 2.0

- Online Loan Navigator

- Calyx ® Point / PointCentral ®

- Encompass360 ®

Contract Mortgage Processing Outsourcing Service for Contract Loan Processors